Understanding the term "HOI" in the real estate world is crucial for both homeowners and investors. This guide will clarify the dual meaning of HOI, highlighting its importance in navigating the complexities of mortgages and homeownership. We will explore both Homeowners Insurance and the Housing Opportunity Index, showing how they impact your financial decisions. For more on mortgage clauses, see this resource.

Understanding the Two Meanings of HOI

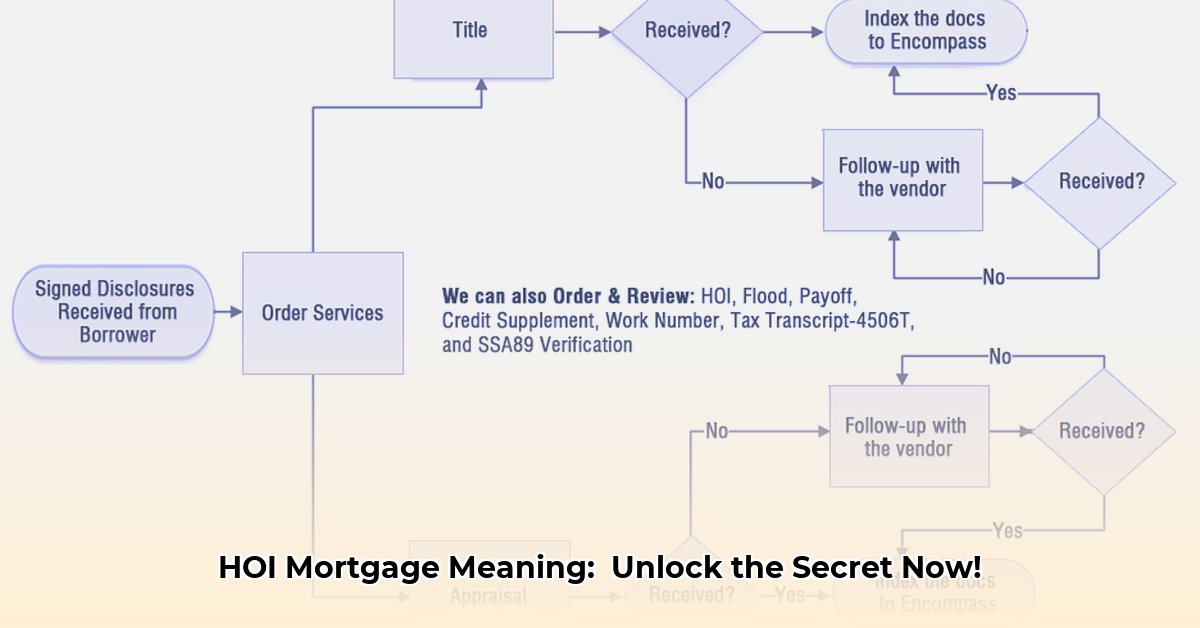

The acronym "HOI" in real estate can refer to two distinct concepts:

- Homeowners Insurance (HOI): This protects your home and its contents from damage or loss. It's a financial safety net required by most mortgage lenders.

- Housing Opportunity Index (HOI): This measures the affordability of housing in a specific area, indicating the percentage of homes accessible to families with median incomes.

Homeowners Insurance (HOI): Protecting Your Investment

Homeowners insurance is a critical component of homeownership. It covers various aspects of your property and personal possessions, ensuring financial protection against unforeseen events. Why is it essential? Because it safeguards your largest investment — your home. Mortgage lenders insist on it as they also need to protect their financial stake until the mortgage is paid off.

What does a typical homeowners insurance policy cover?

- Dwelling Coverage: This protects the structure of your home from damage due to events like fire, windstorms, or vandalism.

- Personal Property Coverage: This covers your belongings inside the house, such as furniture, electronics, and clothing.

- Liability Coverage: This protects you if someone is injured on your property. It covers legal fees and medical expenses.

- Additional Living Expenses (ALE): If your home becomes uninhabitable due to damage, ALE covers temporary housing and essential living expenses.

Choosing the Right Homeowners Insurance: Finding the right balance between cost and coverage is key. Higher deductibles (the amount you pay before insurance coverage starts) generally lower premiums. However, a higher deductible means more out-of-pocket expenses in case of an incident. Comparing quotes from multiple insurers is imperative to find a policy that aligns with your budget and risk tolerance.

Housing Opportunity Index (HOI): Gauging Housing Affordability

The Housing Opportunity Index (HOI) provides a valuable indicator of housing affordability within a specific geographic area. It expresses the percentage of homes that are financially accessible to households earning the median income in that region. A high HOI score suggests a more affordable housing market. Conversely, a low HOI score indicates a more competitive and expensive market.

Impact of the HOI:

- Homebuyers: A low HOI suggests a highly competitive market with potentially higher prices and increased difficulty in securing a home.

- Homesellers: A higher HOI may lead to a faster sale due to a larger pool of potential buyers.

- Real Estate Investors: The HOI is a vital tool for evaluating investment opportunities, helping to predict market stability and potential returns.

The Interplay Between Homeowners Insurance and Housing Affordability

While seemingly disparate, these two meanings of "HOI" are interconnected. High homeowners insurance premiums in a specific area can reduce housing affordability, directly impacting the HOI score. Conversely, areas with low HOIs (meaning less affordable housing) may see increased insurance premiums due to the higher value of properties and elevated risks. Areas susceptible to natural disasters often illustrate this interplay vividly, experiencing both higher insurance costs and lower HOIs.

Actionable Steps Based on Your Role

Understanding both Homeowners Insurance and the Housing Opportunity Index is crucial for making informed decisions. Here’s how to apply this knowledge depending on your position in the real estate landscape:

| Stakeholder | Actionable Steps |

|---|---|

| Home Buyers | Obtain multiple homeowners insurance quotes to compare prices and coverage. Understand the impact of deductibles on premiums before securing a mortgage. |

| Home Sellers | Accurately factor homeowners insurance costs into your property pricing strategy and transparently disclose your insurance history to potential buyers. |

| Real Estate Agents | Thoroughly understand both HOI concepts. Advise clients on suitable insurance policies and facilitate comprehensive rate comparisons. |

| Mortgage Lenders | Stringently enforce homeowners insurance requirements. Integrate HOI data into risk assessment procedures. |

| Policymakers/Regulators | Closely monitor HOI trends to develop effective and responsive housing policies. Analyze the influence of homeowners insurance premium fluctuations on overall affordability. |

In conclusion, grasping the dual meaning of "HOI" is essential for anyone involved in the real estate market. This knowledge empowers informed decisions and contributes to greater success in navigating the complexities of homeownership and investment. Remember to conduct thorough research, as the relationship between these factors continues to evolve.